Installturbotax.com

InstallTurboTax.com, a trusted tax preparation platform for downloading and installing TurboTax software. It offers a seamless process to redeem your license code, download the software, and get started with tax filing for the latest tax year. Install TurboTax with ease at installturbotax com. Enter your 16-digit license code to download and install TurboTax software. Follow the simple installation process and activate your software with the license code. Get started with tax preparation and take advantage of maximum refunds and accuracy guaranteed by TurboTax.

How TurboTax Works for Filing Taxes?

- Sign up or log in to your TurboTax account.

- Select a TurboTax version based on your tax filing needs, such as Basic, Deluxe, Premier, or Self-Employed.

- Provide details like your name, address, and Social Security Number.

- Upload W-2s, 1099s, and other forms directly or enter them manually.

- TurboTax uses a Q&A format to identify deductions, credits, and tax-saving opportunities.

- The software checks for errors, calculates your refund or taxes owed, and allows you to file electronically with the IRS.

Access your Turbotax account

- Go to installturbotax.com.

- Click on the "Sign In" button at the top right corner of the homepage.

- Input your registered email or user ID and password.

- Click on the "Sign In" button to access your TurboTax account.

If you need help:

- Forgot password: Click "Forgot password" and follow the prompts.

- Forgot username: Contact TurboTax support.

- Account locked: Contact TurboTax support for assistance.

Download and Install TurboTax with License Code

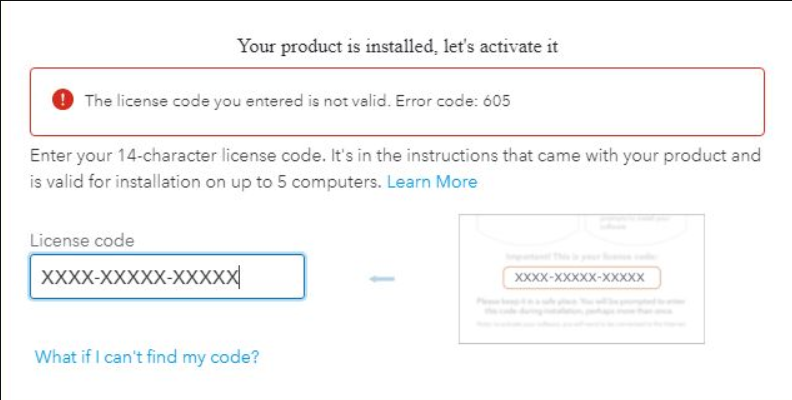

- Ensure you have purchased TurboTax, either online or from a retailer, and have your license code handy.

- Visit the official TurboTax download page: InstallTurboTax.com.

- Log in with your TurboTax account credentials, or create a new account if you’re a first-time user.

- Input the 16-character license code provided in your purchase confirmation or on the retail box.

- Select the version you purchased (e.g., Basic, Deluxe, Premier, or Self-Employed) and click Download.

- Open the downloaded file.

- Follow the on-screen instructions to complete the installation process.

- Launch TurboTax and enter the same license code to activate the software.

- Begin your tax preparation by following the guided steps.

Tax Deductions And Credits You Can’t Claim On Your Tax Return

There are certain tax deductions and credits that you can't claim on your tax return. Here are some examples:

- Work Clothes: General clothing, even if required for work, is not deductible.

- Plastic Surgery: Cosmetic surgery, unless it's necessary for medical reasons, is not deductible.

- Time Spent as a Volunteer: The value of your time spent volunteering is not deductible.

- Child Support Payments: These payments are not deductible.

- Family Pet: Expenses related to your family pet are not deductible.

- Sleep Away Camp: Costs for sending your child to sleep away camp are not deductible.

- Pool: Personal swimming pools are not deductible.

- Donations to Non-Qualified Organizations: Donations to organizations that are not recognized by the IRS are not deductible.